受益所有权信息合规报告-豁免23种公司形式

For any questions, please contact: cpa@cindiellc.com 732-896-0272 https://cindiellc.com/form/

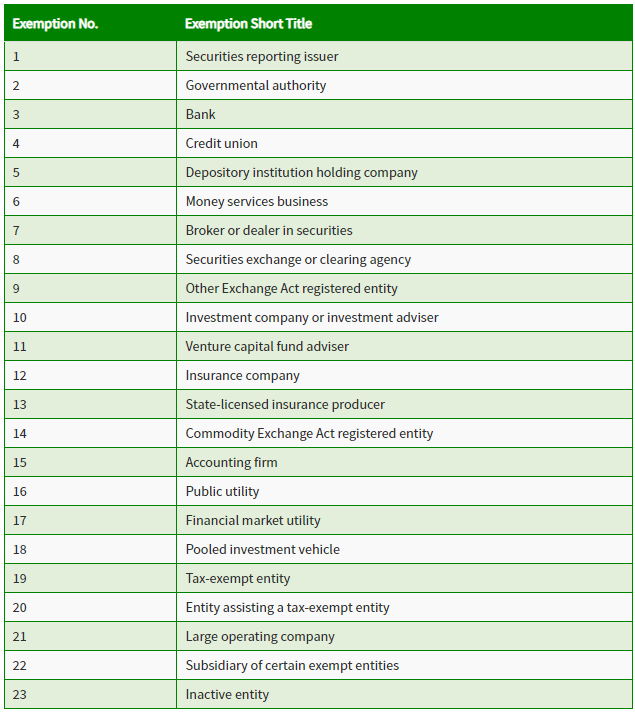

1. Securities reporting issuer: that is: (A) an issuer of a class of securities registered under Sec. 12 of the Securities Exchange Act of 1934, or (B) required to file supplementary and periodic information under Sec. 15(d) of the Securities Exchange Act of 1934.

2. Governmental authority:that: (A) is established under the laws of the United States, an Indian tribe, a State, or a political subdivision of a State, or under an interstate compact between two or more States, and (B) exercises governmental authority on behalf of the United States or any such Indian tribe, State, or political subdivision.

3. Bank:as defined in: (A) Sec. 3 of the Federal Deposit Insurance Act, (B) Sec. 2(a) of the Investment Company Act of 1940, or (C) Sec. 202(a) of the Investment Advisers Act of 1940.

4. Credit union:Federal credit union or State credit union, as those terms are defined in Sec. 101 of the Federal Credit Union Act.

5. Depository institution holding company: bank holding company as defined in Sec. 2 of the Bank Holding Company Act of 1956, or any savings and loan holding company as defined in Sec. 10(a) of the Home Owners’ Loan Act.

6. Money services business:money transmitting business registered with FinCEN under 31 U.S.C. 5330, and any money services business registered with FinCEN under 31 CFR 1022.380.

7. Broker or dealer in securities:broker or dealer, as those terms are defined in Sec. 3 of the Securities Exchange Act of 1934, that is registered under Sec. 15 of that Act.

8. Securities exchange or clearing agency:exchange or clearing agency, as those terms are defined in Sec. 3 of the Securities Exchange Act of 1934, that is registered under Secs. 6 or 17A of that Act.

9. Other Exchange Act registered entity:Any entity other than that described in exemption 1 (Securities reporting issuer), exemption 7 (Broker or dealer in securities), or exemption 8 (Securities exchange or clearing agency) that is registered with the SEC under the Securities Exchange Act of 1934.

10. Investment company or investment adviser:Any entity that is: (A) an investment company as defined in Sec. 3 of the Investment Company Act of 1940, or is an investment adviser as defined in Sec. 202 of the Investment Advisers Act of 1940, and (B) registered with the SEC under the Investment Company Act of 1940 or the Investment Advisers Act of 1940.

11. Venture capital fund adviser:Any investment adviser that: (A) is described in section 203(l) of the Investment Advisers Act of 1940, and (B) has filed Item 10, Schedule A, and Schedule B of Part 1A of Form ADV, or any successor thereto, with the SEC.

12. Insurance company:Any insurance company as defined in Sec. 2 of the Investment Company Act of 1940.

13. State-licensed insurance producer:Any entity that: (A) is an insurance producer that is authorized by a State and subject to supervision by the insurance commissioner or a similar official or agency of a State, and (B) has an operating presence at a physical office within the United States.

14. Commodity Exchange Act registered entity:Any entity that: (A) is a registered entity as defined in Sec. 1a of the Commodity Exchange Act, or (B) is: (1) a futures commission merchant, introducing broker, swap dealer, major swap participant, commodity pool operator, or commodity trading advisor, each as defined in Sec. 1a of the Commodity Exchange Act, or a retail foreign exchange dealer as described in Sec. 2(c)(2)(B) of the Commodity Exchange Act and (2) registered with the Commodity Futures Trading Commission under the Commodity Exchange Act.

15. Accounting firm:Any public accounting firm registered in accordance with Sec. 102 of the Sarbanes-Oxley Act of 2002.

16. Public utility:Any entity that is a regulated public utility as defined in 26 USC 7701(a)(33)(A) that provides telecommunications services, electrical power, natural gas, or water and sewer services within the United States.

17. Financial market utility:Any financial market utility designated by the Financial Stability Oversight Council under Sec. 804 of the Payment, Clearing, and Settlement Supervision Act of 2010.

18. Pooled investment vehicle:Any pooled investment vehicle that is operated or advised by a person described in exemptions 3 (bank), 4 (credit union), 7 (broker or dealer in securities), 10 (investment company or investment adviser), or 11 (venture capital fund adviser).

19. Tax-exempt entity:Any entity that is: (A) an organization that is described in Sec. 501(c) of the Internal Revenue Code of 1986 (determined without regard to Sec. 508(a) of the Code) and exempt from tax under Sec. 501(a) of the Code, except that in the case of any such organization that ceases to be described in Sec. 501(c) and exempt from tax under Sec. 501(a), such organization shall be considered to continue to be described as a tax-exempt entity for the 180-day period beginning on the date of the loss of such tax-exempt status, (B) a political organization, as defined in Sec. 527(e)(1) of the Code, that is exempt from tax under Sec. 527(a) of the Code, or (C) a trust described in paragraph (1) or (2) of Sec. 4947(a) of the Code.

20. Entity assisting a tax-exempt entity:Any entity that: (A) operates exclusively to provide financial assistance to, or hold governance rights over, any entity described in exemption 19 above (tax-exempt entity), (B) is a United States person, (C) is beneficially owned or controlled exclusively by one or more United States persons that are United States citizens or lawfully admitted for permanent residence, and (D) derives at least a majority of its funding or revenue from one or more United States persons that are United States citizens or lawfully admitted for permanent residence.

21. Large operating company:Any entity that: (A) employs more than 20 full time employees in the United States, with “full time employee in the United States” having the meaning provided in 26 CFR 54.4980H-1(a) and 54.4980H-3, except that the term “United States” as used in those sections of the CFR have the meaning provided in 31 CFR 1010.100(hhh), (B) has an operating presence at a physical office within the United States, and (C) filed a Federal income tax or information return in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales, as reported as gross receipts or sales (net of returns and allowances) on the entity’s IRS Form 1120, consolidated IRS Form 1120, IRS Form 1120-S, IRS Form 1065, or other applicable IRS form, excluding gross receipts or sales from sources outside the United States, as determined under Federal income tax principles. For an entity that is part of an affiliated group of corporations within the meaning of 26 USC 1504 that filed a consolidated return, the applicable amount shall be the amount reported on the consolidated return for such group.

22. Subsidiary of certain exempt entities:Any entity whose ownership interests are controlled or wholly owned, directly or indirectly, by one or more entities described in exemptions 1, 2, 3, 4, 5, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 19, or 21 set forth above.

23. Inactive entity:Any entity that: (A) was in existence on or before January 1, 2020, (B) is not engaged in active business, (C) is not owned by a foreign person, whether directly or indirectly, wholly or partially, (D) has not experienced any change in ownership in the preceding twelve-month period, (E) has not sent or received any funds in an amount greater than $1,000, either directly or through any financial account in which the entity or any affiliate of the entity had an interest, in the preceding 12 month period, and (F) does not otherwise hold any kind or type of assets, whether in the United States or abroad, including any ownership interest in any corporation, limited liability company, or other similar entity.

- 证券报告发行人:任何证券发行人,即:(A) 根据 1934 年证券交易法第 12 条注册的一类证券的发行人,或 (B) 根据 1934 年证券交易法第 15(d) 条需要提交补充和定期信息的人。

- 政府机构:任何实体,即:(A) 根据美国法律、印第安部落、州或州的政治分支机构的法律或根据两个或多个州之间的州际协议成立,并且 (B) 代表美国或任何此类印第安部落、州或政治分支机构行使政府权力。

- 银行:任何银行,定义见:(A) 联邦存款保险法第 3 条,(B) 1940 年投资公司法第 2(a) 条,或 (C) 第 4 条。 1940 年《投资顾问法》第 202(a) 条。

- 信用合作社:任何联邦信用合作社或州信用合作社,这些术语的定义见《联邦信用合作社法》第 101 条。

- 存款机构控股公司:任何银行控股公司,定义见 1956 年《银行控股公司法》第 2 条,或任何储蓄和贷款控股公司,定义见《房主贷款法》第 10(a) 条。

- 货币服务业务:任何根据美国法典第 31 章第 5330 条在 FinCEN 注册的货币转账业务,以及任何根据联邦法典第 31 章第 1022.380 条在 FinCEN 注册的货币服务业务。

- 证券经纪人或交易商:任何根据 1934 年《证券交易法》第 3 条定义,并根据该法第 15 条注册的经纪人或交易商。

- 证券交易所或清算机构:根据《1934 年证券交易法》第 3 节定义并根据该法第 6 节或第 17A 节注册的任何证券交易所或清算机构。

- 其他证券交易法注册实体:除豁免 1(证券报告发行人)、豁免 7(证券经纪人或交易商)或豁免 8(证券交易所或清算机构)中所述实体之外,根据《1934 年证券交易法》在证券交易委员会注册的任何实体。

- 投资公司或投资顾问:以下任何实体:(A) 1940 年投资公司法第 3 节定义的投资公司,或第 3 节定义的投资顾问。 1940 年《投资顾问法》第 202 条,并且 (B) 根据 1940 年《投资公司法》或 1940 年《投资顾问法》在 SEC 注册。

- 风险投资基金顾问:任何符合以下条件的投资顾问:(A) 符合 1940 年《投资顾问法》第 203(l) 条的规定,并且 (B) 已向 SEC 提交 ADV 表格第 1A 部分第 10 项、附表 A 和附表 B 或其后续文件。

- 保险公司:任何符合 1940 年《投资公司法》第 2 条规定的保险公司。

- 州许可的保险生产商:任何符合以下条件的实体:(A) 是经州授权并受州保险专员或类似官员或机构监管的保险生产商,并且 (B) 在美国境内设有实体办事处。

- 商品交易法注册实体:任何符合以下条件的实体:(A) 是《商品交易法》第 1a 条定义的注册实体,或 (B) 是:(1) 期货佣金商、介绍经纪人、掉期交易商、主要掉期参与者、商品池运营商或商品交易顾问(均定义见《商品交易法》第 1a 条),或《商品交易法》第 2(c)(2)(B) 条描述的零售外汇交易商,且 (2) 已根据《商品交易法》在商品期货交易委员会注册。

- 会计师事务所:任何根据第 1a 条注册的公共会计师事务所。 2002 年《萨班斯-奥克斯利法案》第 102 条。

- 公用事业:任何受监管的公用事业实体,如 26 USC 7701(a)(33)(A) 所定义,在美国境内提供电信服务、电力、天然气或水和下水道服务。

- 金融市场公用事业:任何由金融稳定监督委员会根据 2010 年《支付、清算和结算监管法》第 804 条指定的金融市场公用事业。

- 集合投资工具:任何由豁免条款 3(银行)、4(信用合作社)、7(证券经纪人或交易商)、10(投资公司或投资顾问)或 11(风险投资基金顾问)中描述的人员运营或提供建议的集合投资工具。

- 免税实体:任何符合以下条件的实体:(A) 1986 年国内税收法典第 501(c) 条所描述的组织(不考虑法典第 508(a) 条的规定而确定)并且根据法典第 501(a) 条免税的组织,但如果任何此类组织不再符合第 501(c) 条的规定并且不再根据第 501(a) 条免税,则该组织应被视为在丧失此类免税地位之日起 180 天内继续被描述为免税实体,(B) 法典第 527(e)(1) 条定义的政治组织,根据法典第 527(a) 条免税,或(C) 第 (1) 或 (2) 款所描述的信托,税法第 4947(a) 条。

- 协助免税实体的实体:任何实体:(A) 专门为上述豁免条款 19 中描述的任何实体(免税实体)提供财务援助或持有其治理权,(B) 为美国人,(C) 由一个或多个身为美国公民或合法获得永久居留权的美国人独家拥有或控制,并且 (D) 其资金或收入的至少大部分来自一个或多个身为美国公民或合法获得永久居留权的美国人。

- 大型运营公司:任何实体:(A)在美国雇用超过20名全职员工,“美国全职员工”具有26 CFR 54.4980H-1(a)和54.4980H-3中规定的含义,但CFR这些章节中使用的“美国”一词具有31 CFR 1010.100(hhh)中规定的含义,(B)在美国境内设有实体办事处,并且(C)在美国提交了上一年的联邦所得税或信息申报表,证明总收入或销售额超过5,000,000美元,并在实体的IRS表格1120,合并的IRS表格1120,IRS表格1120-S,IRS表格1065或其他适用的IRS表格中报告为总收入或销售额(扣除退货和折让)形式,不包括根据联邦所得税原则确定的来自美国境外来源的总收入或销售额。对于属于 26 USC 1504 所定义的关联公司集团并已提交合并申报表的实体,适用金额应为该集团合并申报表上报告的金额。

- 某些豁免实体的子公司:其所有权权益直接或间接由上述豁免 1、2、3、4、5、7、8、9、10、11、12、13、14、15、16、17、19 或 21 中描述的一个或多个实体控制或全资拥有的任何实体。

- 非活跃实体:指符合以下条件的任何实体:(A)2020 年 1 月 1 日或之前存在;(B)未从事活跃业务;(C)不由外国人直接或间接、全部或部分拥有;